BIBD At-Tamwil wins Best Verification Tech ID Award from The Asian Banker

- Awards, Banking, Digital

The Asian Banker announced BIBD At-Tamwil Berhad as the winner of the Best ID Verification Technology Implementation Award. This is their second recognition from The Asian Banker, the first being in 2014 for Best Risk Data and Analytics for AI implementation with FICO, making them the first finance company in Brunei to use AI for financing decisions, enabling on-the-spot approvals for customers.

BIBD At-Tamwil Berhad’s Olive Pro mobile application became the first to be approved by the Brunei Darussalam Central Bank (BDCB) to implement electronic know your customer (eKYC), enabling remote customer onboarding for services such as savings account openings, term deposits, and financing applications. This eKYC implementation was recognised by The Asian Banker, a prominent and respected provider of research and strategic intelligence in the global financial services industry, as an important step forward for Brunei to be on par with digital banks in the region.

The Olive mobile application is part of BIBD Group’s initiative to refresh and modernise its technology stack to match or surpass the best digital banks in the ASEAN region. BIBD Group aims to provide a seamless, safe, and reliable digital banking experience for all its customers. The project includes implementing digital signatures and blockchain-based digital contracts, leveraging Digital ID, which will be made interoperable across the entire BIBD Group.

The effective and reliable use of eKYC and Digital ID technologies, as acknowledged by The Asian Banker award, is a fundamental building block for demonstrating compliance with BDCB regulations and providing a safe, irrefutable digital ID and digital banking experience for BIBD Group. BIBD Group is committed to continuously learning, adopting, and conducting research and development, regularly releasing new updates to enhance its Olive ecosystem and ensure seamless and secure access to financial products and services for all its customers.

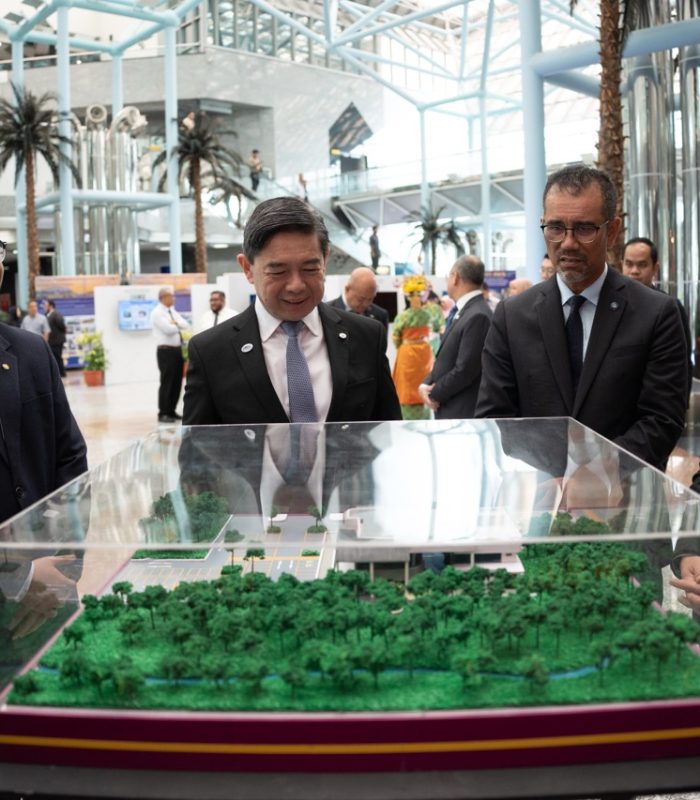

Tuan Hj Mohammad Said bin Hj Zania, BIBD At-Tamwil’s Managing Director, who received the award from The Asian Banker, expressed his gratitude for the opportunity to represent Brunei’s progress in digital banking transformation at the gathering of top bankers from around the world in Hong Kong. He thanked the BIBD Group’s Chairman and Board Members, Brunei Darussalam Central Bank, the Syariah Advisory Body, management, the Olive team, and all BIBD’s Group and BIBD At-Tamwil Berhad customers for their support and guidance in this ongoing effort.

YM Profesor Madya Dr. Abdul Nasir bin Haji Abdul Rani, the Chairman of the Syariah Advisory Body for BIBD At-Tamwil Berhad, emphasised in his journal, “Project Olive: Transforming Islamic Thought and AI Technology Practices in the Islamic Finance Industry,” that Islam is a progressive religion encouraging efforts to improve the living standards and conditions of its ummah. In his journal, he cited the Prophet (peace and blessings be upon him), who said: “Facilitate things to people (concerning religious matters), and do not make it hard for them, and give them good tidings and do not make them run away (from Islam).” (Sahih Bukhari, Volume 1, Book 3, Hadith 69).

Share what you've learned

You may also enjoy

BIBD highlights Connects Temburong in Official Launch of 12th National Development Plan

BIBD recognised as Most Sustainable Financial Institution of the Year in Brunei