BIBD Management Partcipates in Prestigious Cambridge Islamic Finance Structuring Master Programme

- Banking, Islamic Finance, Professional Development

As part of Bank Islam Brunei Darussalam’s (BIBD) efforts to strengthen its position as a leader in Islamic finance, two members of its senior management, Hj Mohammad Yusri bin Hj Wahsalfelah, Head of Government Relations and Special Projects, and Junaidi Bahrum, Head of Retail Banking, have successfully completed the Cambridge Islamic Finance Structuring Master Programme (Cambridge IFSM) which was held in Medinah, Saudi Arabia.

The Cambridge IFSM, organised by the Cambridge Institute of Islamic Finance (Cambridge IIF) in collaboration with the Bahrain Institute of Banking and Finance (BIBF), is one of the most advanced training programmes in Islamic finance. The five-day programme equips participants with comprehensive knowledge in structuring over 60 Islamic financial products, including Sukuk, Takaful, and Islamic investment products, while ensuring Shariah compliance and economic efficiency. The programme’s strategic focus on innovation and financial inclusion reflects the growing need for Islamic financial institutions to adapt to an evolving market landscape.

The training covered key areas such as:

- Structuring Islamic Investment Products – Developing innovative investment structures, including I-REITs, private equities, and Sukuk, while maintaining Shariah compliance.

- Use of Technology in Islamic Finance – Exploring the role of FinTech in enhancing product development and customer experience.

- Financial Inclusion Structures – Designing microfinance products to increase access to financial services and promote financial inclusion.

- Islamic Social Finance and Mutuality – Structuring Takaful and cooperative models to support social impact-driven financial solutions.

- Innovation in Sukuk – Introducing new Sukuk structures, including liquidity management and structured products.

BIBD’s participation in this programme reflects its strategic focus on product innovation, digital transformation, and financial inclusion—key pillars that align with Brunei Vision 2035 and the BDCB Financial Sector Blueprint, and as part of ongoing efforts to offer innovative, Shariah-compliant financial solutions that meet evolving customer needs and reinforce its status as Brunei’s flagship Islamic financial institution.

This participation also highlights BIBD’s ongoing investment in developing talent and leadership capabilities to drive long-term value for its customers and stakeholders.

Share what you've learned

You may also enjoy

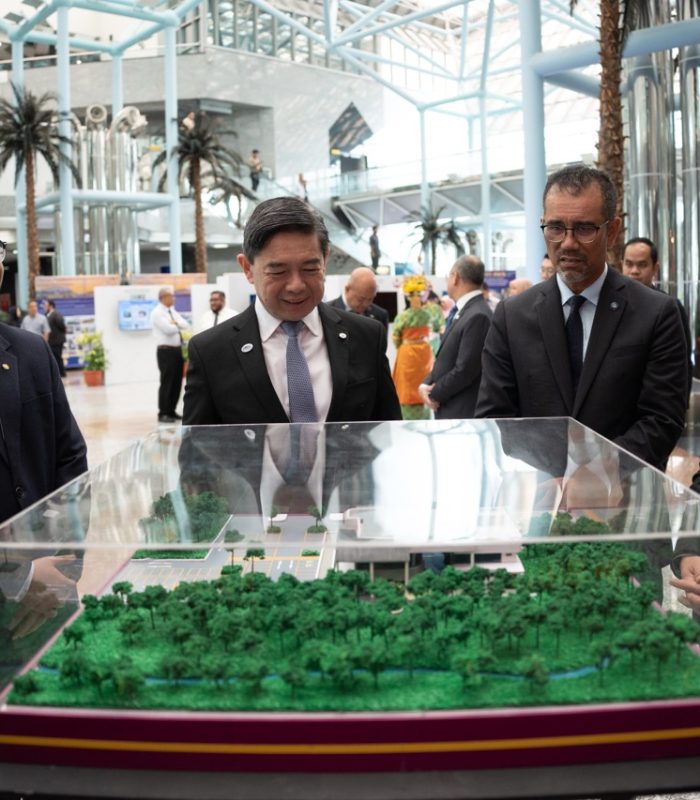

BIBD highlights Connects Temburong in Official Launch of 12th National Development Plan

BIBD recognised as Most Sustainable Financial Institution of the Year in Brunei