DigiCon 2023 Pioneers Digital Transformation and Innovation in Banking

- Banking, Digital, Featured, Forum

The inaugural Olive Digital Innovation Conference or DigiCon 2023, hosted by the BIBD Group is a crucial part of the BIBD Group’s digital transformation journey and set the stage for a future where industry leaders, the public, and the global community can explore and understand the evolving landscape of the 4th Industrial Revolution (IR4.0) and Bank 4.0. DigiCon 2023, held in conjunction with BIBD’s 30th anniversary, exemplified inclusivity and showcased the opportunities that arise from these transformative technologies, underlining the BIBD Group’s unwavering commitment to innovation in the financial sector.

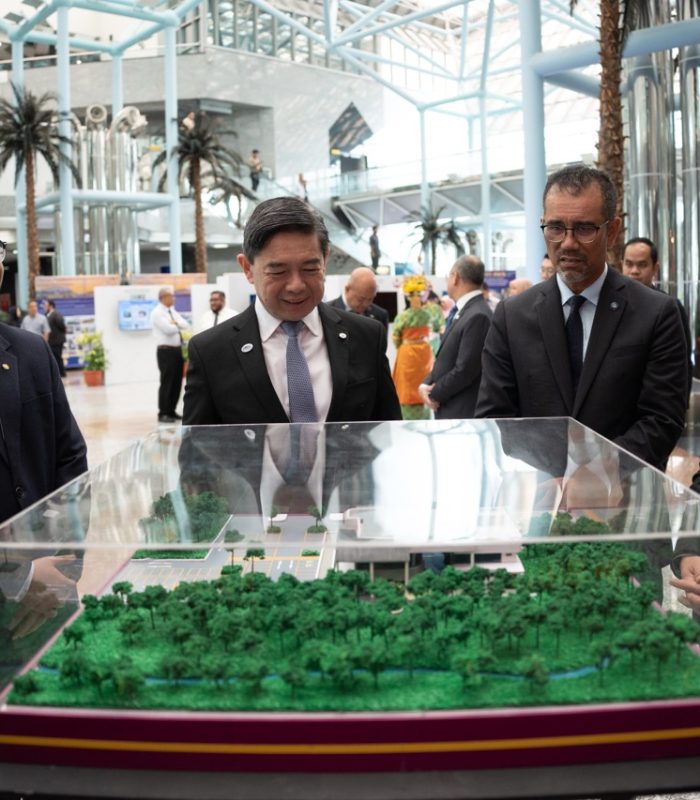

The conference, held at the Plenary Hall of the International Convention Centre and attended by more than 900 delegates, served as a platform for in-depth discussions on how Bank 4.0’s digital advancements intersect with critical topics within the banking sector, particularly in the areas of cybersecurity and data protection.

The event saw the official launch of the Project Olive Journal, authored by Associate Professor Dr. Abdul Nasir bin Haji Abdul Rani, Chairman of BIBD’s Shariah Advisory Body, and Irwan Lamit, Deputy Managing Director, Head of Retail Banking and Chief Information Officer of BIBD. The journal delves into essential aspects of digital banking and its compatibility with Islamic finance principles, providing a valuable resource for the industry.

Yang Berhormat Dato Seri Setia Dr Hj Mohd Amin Liew bin Abdullah, Chairman of the BIBD Group and Minister at the Prime Minister’s Office and Minister of Finance & Economy II, in his keynote speech outlined the pivotal transformations in the BIBD Group’s history.

According to Yang Berhormat Dato, “In embracing these innovations, the BIBD Group must also identify both the opportunities and threats they present. Effective and safe utilisation is essential for continued growth and prosperity. We must aim to master these technologies and create our own intellectual property, not merely consume them.”

He added, “The BIBD Group has set out ambitious goals under Project Olive – to implement Olive across the Group by 2025 in order to continue to provide customer service excellence, address their evolving needs, and to align with the vision of a Smart Nation as outlined by the Brunei Digital Economy Masterplan.”

Mr. Emmanual Danial, Chairman of the Asian Banker, also delivered a keynote presentation on ‘The Great Transition,’ discussing the evolution of the banking industry, with a particular focus on personalisation.

DigiCon 2023 highlights the BIBD Group’s dedication to innovation and progress in the financial sector, and the Group’s commitment to creating greater awareness and understanding of the opportunities and challenges facing the industry in transforming to Bank 4.0. The conference featured four main forums, each addressing critical aspects of the digital transformation.

Forum 1, titled Bank 4.0, explored how traditional banks are redefining themselves in the era of IR4.0, and examined the challenges and opportunities in creating personalised customer experiences. Experts and industry leaders also discussed the strategies required to transition from traditional banking to Bank 4.0.

Forum 2, Zero Trust Approach and Fraud Prevention, was dedicated to addressing cybersecurity challenges in the banking industry, particularly focusing on financial fraud prevention and enhanced security measures. The forum provided insights into the latest advancements in security protocols and anti-fraud measures.

Forum 3 focused on Personal Data Protection in the Digital Age and delved into how banks and financial institutions ensure compliance with the emerging Personal Data Protection Order (PDPO). The forum discussed protecting customer data from unauthorised access and breaches, emphasising best practices, protocols, and future measures to be implemented. It provided invaluable insights into the evolving landscape of data protection.

Meanwhile, Forum 4, Advancing Local and Cross-Border Payments, examined how local banks can embrace advancements in digital payment technologies to make both local and international transactions faster, cheaper, safer, and more convenient. The forum discussed the latest innovations in payment systems and their impact on local and cross-border financial transactions.

DigiCon 2023 also featured 15 exhibitors from various industries, each of which has embarked on its own journey into IR4.0. These exhibitors provided a firsthand look at their cutting-edge digital products, demonstrating how these innovations are making a tangible impact on today’s world.

The event underscores the BIBD Group’s ongoing efforts to engage and inform people about the immense opportunities presented by Bank 4.0 and, more specifically, Olive, as it forges ahead into a digital future. DigiCon 2023 represents the BIBD Group’s commitment to shaping the future of banking and embracing the transformative power of digital innovation, bringing together thought leaders, industry experts, and the public to explore the evolving landscape of digital banking and set the course for a more inclusive, secure, and prosperous future.

Share what you've learned

You may also enjoy

BIBD highlights Connects Temburong in Official Launch of 12th National Development Plan

BIBD recognised as Most Sustainable Financial Institution of the Year in Brunei