Foreign Currency Account

A current account facility in your choice of foreign currencies.

-

Eligibility

Companies registered or incorporated in Negara Brunei Darussalam, either in the form of a proprietorship, partnership or private limited company.

-

Required Documents

For Proprietorship & Partnership Company:

Certificate of Registration - Section 16 and 17

Original copy of identity card(s) of the propreitor/ partners/ signatories

For Private Limited Company

Certificate of Incorporation

Particulars of Directors and Shareholders (Form X)

Original copy of identity cards of the directors/signatories

Directors' Resolution to open/maintain term Investments -

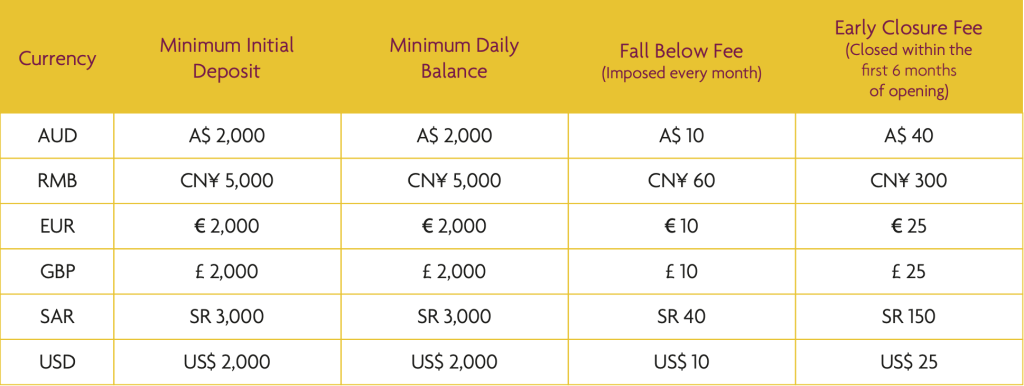

Fees and Requirements

Minimum Opening Deposit

Minimum opening deposit in the specified foreign currency (FCY) is required.

You may refer to the Bank's Schedule of Tariffs for more fee information.

Features

-

Transact in: AUD, EUR, GBP. RMB, SAR, and USD

-

Telegraphic Transfer or Demand Draft at any of our counter services

-

Easy track of transaction via BizNet

-

Foreign currencies and remittances facilities

Wakalah

Refers to Agency contract. The Depositor (“Muwakkil”) appoints the Bank as their agent (“Wakil”) to utilize and invest their deposits in profitable Shariah-compliant transactions. The Depositor will be offered an expected profit rate from the investments and the Bank will earn an Agency (“Wakalah”) Fee for the service rendered. Any amount that the Bank earns in excess of the Depositor’s expected profit will be retained by the Bank as Commission (“Ju’alah”).