Asset Management

Local Expertise with Global Excellence

Who Are We?

We are the first and only fully fledged Shariah-Compliant asset manager in Brunei Darussalam, offering discretionary and advisory investment management services to institutional clients in Brunei and international markets.

BIBD Asset Management envisages to become a global player in the Islamic Asset Management industry.

Homegrown investment professionals with established industry experience

1st Bruneian Financial Institution to become a signatory for United Nations Principal of Responsible Investing (“UNPRI”)

Committed to integrating Environmental, Social and Governance (ESG) standards across our business

Local and regional insight and access to markets

Key Objectives

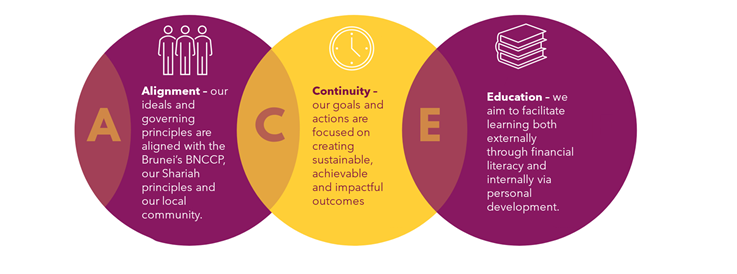

In line with Brunei’s Wawasan 2035 and BDCB’s Financial Blueprint, BIBDS envisions becoming a global player in the Islamic Asset Management industry.

1

Develop Brunei’s Asset Management Industry

2

Build New and Innovative Products

3

Export Our Services Overseas

Our Product Offerings

Global Sukuk

High conviction IG Sukuk strategy – aiming to generate higher risk-adjusted returns than the Sukuk benchmark.

ESG Sukuk

Utilizing a systematic ESG filter and ESG scoring to provide ESG returns to our clients.

Liquidity Strategy

Liquidity management strategy that invests in low-duration sukuk and money market to enhance cash returns.

Multi-Asset Solutions

Using our systematic portfolio optimization model to build well diversified, risk-adjusted portfolios for our clients.

Equity

We have partnered with 5 world class equity managers to offer a broad range of bespoke and actively managed Islamic equity strategies.

Investment Advisory

Outsourced CIO model in which we provide macro-economic research and recommended trades to our clients.

Competitive Advantage

Our goal is to be our clients’ life-long investing partner – offering long-term solutions to our clients as we provide bespoke and sustainable investment solutions at competitive costs.

BIBD Group Synergies

Our BIBD group structure allows us to tap into additional sources of expertise and connectivity as we have a wide range of relationships with issuers, banks and brokers.

Research

Our investment decisions are 100% research-driven – allowing us to implement our high conviction, low turnover investment style.

Risk-Focused

We maintain a dynamic risk management strategy allowing flexibility to adjust high risk tolerance as circumstances change.

Islamic Expertise

As the only Bruneian asset manager, with a strong Sukuk track record of 10 years, we provide a unique perspective to the global Islamic markets.

Shariah Perspective

Shariah principles are ingrained in our investment management process.

• Our investment philosophies are guided by our Shariah Advisory Body ("SAB") and internal Shariah team.

• We invest in tried-and-tested Wakalah, Murabahah and Mudarabah Sukuk structures.

• Securities that have been identified as Shariah non-compliant are responded promptly.

• Screening process across all asset classes is consistent.

Shariah Universe Identification

Client Portfolio Construction

Ongoing Shariah Monitoring

Shariah Universe Identification

Client Portfolio Construction

Ongoing Shariah Monitoring

• Our SAB is a board-level committee consisting of 3 scholars with a broad range of experiences.

• Members’ experience spans capital markets, investment and product development to ensure strict compliance with Shariah principles.

• The SAB advises on all aspects of investment management, documentation, structuring and products.

Ride the Wave of Sustainable Investing

Shariah Investing and Sustainability Go Hand-in-Hand

Our ESG values are designed to create value for our

Planet, Society, Family, Investors and Employees.

The Six Principles and Signatories' Commitment

As institutional investors, we have a duty to act in the best long-term interests of our beneficiaries. In this fiduciary role, we believe that environmental, social and corporate governance (ESG) issues can affect the performance of investment portfolios (to varying degrees across companies, sectors, regions, asset classes and through time).

We also recognize that applying these Principles may better align investors with broader objectives of society. Therefore, where consistent with our fiduciary responsibilities, we commit to the following:

We will incorporate ESG issues into investment analysis and decision-making processes

We will be active owners and incorporate ESG issues into our ownership policies and practices

We will seek appropriate disclosure on ESG issues by the entities by which we invest

We will promote acceptance and implementation of the Principles within the investment industry

We will work together to enhance our effectiveness in implementing the Principles

We will each report on our activities and progress towards implementing the Principles

Awards and Achievements

Signatory to the United Nations Principles of Responsible Investing

Asia Asset Management

Best of the Best Awards 2022

Asset Triple A Islamic Finance Awards

Islamic Asset Manager of the Year

Best Application of ESG Practices (Finance) Brunei

Global Business Outlook Awards

Asia Asset Management

Best of the Best Awards 2023

Meet our BIBD Asset Management Team

Jason Wong, CFA

Acting Managing Director of BIBD Securities Sendirian Berhad (BIBDS)

Jason has been with BIBD since 2012 and is the Acting Managing Director of BIBD Securities. He has worked across the entire Shariah asset management spectrum with over 10 years of investment management experience. He is currently the secretary of the Brunei Capital Market’s Association

Prior to BIBD Securities, Jason headed the proprietary investment team of BIBD Bank and was responsible for the management of global market investments, including Sukuk (Islamic bonds), Islamic credit-linked notes (I-CLNs) and other medium-term investments.

Additionally, Jason has worked at BIBD’s Singapore representative office, BIBD’s Debt Capital Markets (DCM) team and Citi London. He holds a Master’s degree (MSc) in Finance and a Master’s degree (MEng) in Chemical Engineering, both from Imperial College London. Jason is a CFA charterholder.

FIXED INCOME

Adilah Abu Bakar, CFA

Senior Portfolio Manager, Fixed Income

In August 2023, Adilah assumed the pivotal role of Fixed Income Lead Portfolio Manager at BIBD Asset Management. With close to a decade of enriching experience, she previously specialised in investment performance and risk management at the Brunei Darussalam Central Bank. Her experiences extend beyond her central banking tenure, encompassing impactful contributions to investment and financial development research endeavours.

Aqilah holds a Master’s Degree in Asset and Wealth Management from Nanyang Technological University (NTU) in Singapore and a Bachelor’s Degree in Business, Mathematics and Statistics from London School of Economics and Political Science, United Kingdom.

Aqilah is a CFA charterholder and certified FRM.

Liyana Jamain

Portfolio Manager, Fixed Income

Prior to recently joining BIBD Asset Management in January 2022 as a fixed income portfolio manager,

Liyana was an economist with the Brunei Darussalam Central Bank where she oversaw the development

of national indices and forecasting models. She also has experience in the formulation of policies for the

banking sector.

Liyana holds a Master’s degree (MA) in Comparative Economics and Policy after obtaining

a first class degree with honours in the Bachelor of Science (BSc Hons) Degree in Mathematics with

Economics, both from University College London.

Farah Hishamuddin

Credit Analyst, Fixed Income

Farah Hishamuddin joined BIBD Asset Management in January 2021 as a Credit Analyst. Key areas of responsibilities include bottoms-up credit analysis of Sukuk issuers and conducting macro-economic research on global financial markets.

She graduated from the University of Bristol and holds a BSc (Hons) in Economics and Econometrics with First Class Honours.

She is a yoga and fitness enthusiast with a keen interest in women-led entrepreneurship. Farah plays an active role in implementation of the firmwide ESG initiative and holds position as the ESG Specialist for BIBD AM.

MULTI ASSET SOLUTIONS

Ezza Hani, CFA

Manager, Multi Asset Solutions

Ezza joined BIBD Asset Management in 2020 to assist in broadening its Multi Asset platform and

institutional client base. Prior to this, she worked as an Economist in Brunei Shell Petroleum, responsible

for assessing the economic attractiveness and quantifying the risks of various upstream and downstream

projects.

Prior to that, she was a Portfolio Manager at the Investment Division, Ministry of Finance and Economy where her primary role was to manage the private and public equity portfolios for the Retirement Fund and the Fiscal Stabilization Reserve Fund. Ezza graduated from University of Warwick with a BSc in Mathematics, Operational Research, Statistics and Economics. She is a CFA charterholder.

Adrian Azaharaini

Research Analyst, Multi Asset Solutions

Adrian Azaharaini recently joined BIBD Asset Management in June 2021 as a Research Analyst. His key roles

include assisting in expanding the multi asset initiatives and investment strategies, conducting macroeconomic

research on global financial markets and maintaining relationships with clients and strategic partners.

Adrian is an Actuarial Science graduate with a First Class honours degree from the University of

York. He has a strong passion for basketball and has competed in national tournaments. Adrian is also a

firm believer and active contributor in improving financial literacy amongst the nation’s youth.

BIBD MIDDLE EAST

Alvin Song

Institutional Business Development Manager

Alvin is an Islamic banking professional with hands-on experience in a diverse range of business units. He

is a fixed income portfolio manager, managing external client mandates. Prior to this, he was the lead

credit analyst for BIBD Treasury & Global Markets and was with the Financial Institutions team in BIBD

(covering syndications and trade risk) and BIBD Securities (covering sales and distribution).

He has received a Financial Planning Practitioner license from BDCB and is a Certified Islamic Finance Executive (CIFE) and a CFA Level 1 candidate. Alvin graduated from the University of Kent with a Masters of Science (MSc) in

Forensic Science.

Contact Us

BIBD Asset Management

Level 1, Kompleks Setia Kenangan, Kg Kiulap, Bandar Seri Begawan, BE1518, Brunei Darussalam

T: +673 2238181