What is a fund factsheet?

If you’re just starting to invest in investment funds, reading a fund factsheet is a great way to equip yourself with all the information necessary about the fund.

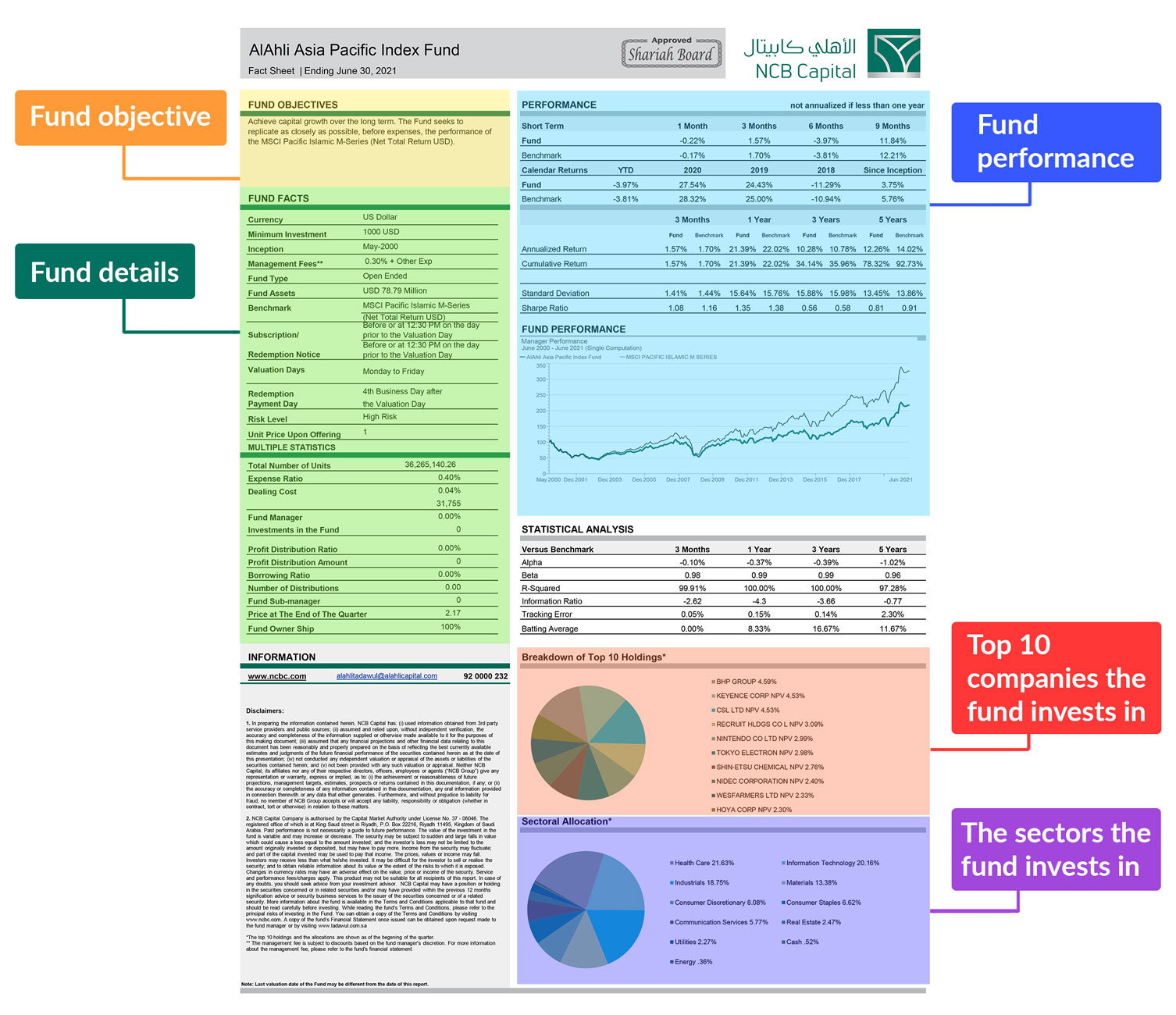

A fund factsheet gives you a comprehensive overview of an investment fund. The factsheet usually tells you the fund’s objectives, the fund’s details, the fund’s asset allocation, what a potential investor’s profile is, the historical returns of a fund, the top holdings of the fund, risk assessment, and the fees involved.

A fund factsheet is usually published every month so investors can get a quick summary of the fund’s performance and the fund manager’s strategy moving forward.

It doesn’t matter if you’re reading a fund factsheet in Brunei or New York; the basis of a fund factsheet is the same that is to provide investors with the information necessary before investing in a fund.

The need-to-knows in every fund factsheet

Fund’s Objective

The fund’s objective primarily tells investors the type of mutual fund you’re investing in, the industry, and the geographical sector of investment.

These are the types of funds that you may come across:

- Equity Fund

- Sukuk/Bond Fund

- Mixed Asset Fund

- Balanced Fund

- Fixed Income / Money Market Fund

- REITs Fund

A fund’s objective will also tell an investor the term of investment, whether it is a short term, or medium to long term investment, and if the fund is seeking capital appreciation, dividend distribution, or both.

If you’re a new investor, it is good to pay attention to these details to see if this fund will be a good fit for you. For example, if you’re comfortable with taking more risk, that is if you’re able to tolerate the short-term ups and downs of the markets, then you might want to invest in a tech-based equity fund that has an aggressive approach to their strategy.

If you’re risk-averse, starting off with a sukuk fund or a balanced fund, is a good way to mitigate any unwanted risk. If you’re someone who’s cautious but wouldn’t mind some sort of risk, then try investing in mixed-asset funds, or simply investing in more than one type of fund.

Funds asset & geographic allocations

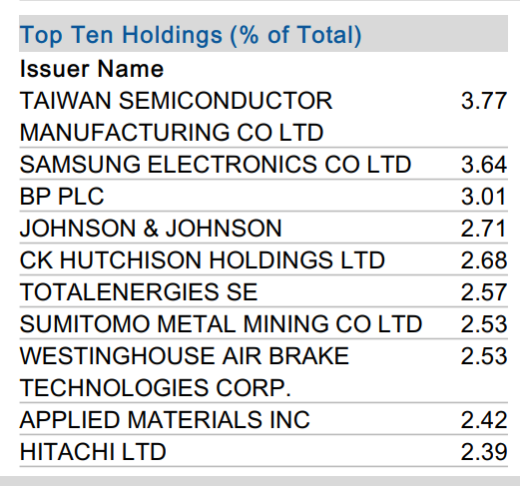

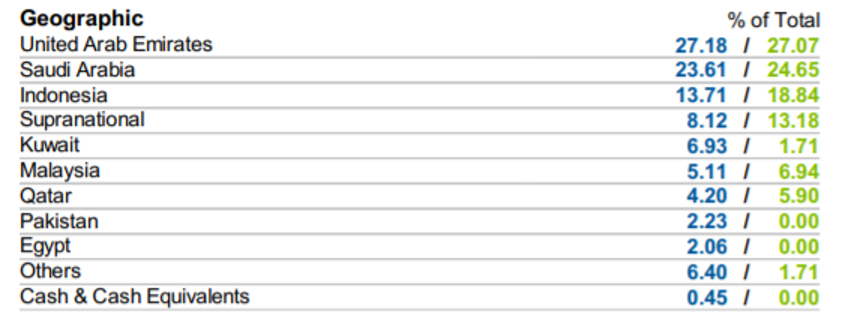

Among the key information in a fund factsheet is the fund’s asset and geographical allocation.

The portfolio content is a useful indicator of the potential returns of a fund. Most fund factsheets will display the “top 10 Holdings’ of a fund. This indicates the top 10 companies that are being invested in, and as an investor, you could have a look if these companies are the ones you see yourself investing in.

If there are only a few holdings to a fund, this indicates an aggressive approach from the fund managers and it is not an ideal option for investors who would like a diversified portfolio.

The fund’s asset allocation will show the different sectors the fund is invested in. It could be a diversified portfolio that contains sectors such as health care, technology, consumer discretionary, and communication services, or it could be a concentrated portfolio that is primarily focused on only two sectors.

Knowing the investment asset will help investors gauge the potential risk that they’re getting themselves into.

As for geographical allocation, if a fund is described as Asian Equity Fund, a fund factsheet will show if the fund is focused on the growth of a particular country or in a diversified selection of countries.

Source: Franklin Global Sukuk Fund, 31 August 2021

Fund X could be invested in China and Hong Kong whereas Fund Y could be invested in China, Taiwan, India, Australia, and Hong Kong. Both these funds can be categorized as Asian Fund but their different geographical allocation will have an impact on the potential returns.

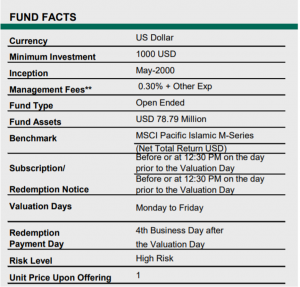

Risk Assessment

Risk assessment is critical for assessing the value of a particular investment and the appropriate processes for risk mitigation. It is important to note the risk of any investment to ensure it will be worth the money you are investing.

In a fund factsheet, you can find the risk assessment, and depending on your personal investment objectives, you can then decide if the fund is too risky or suitable for you.

For example, this AI Ahli Asia Pacific Index Fund by NCB Capital is a high-risk fund and is stated in the fund fact sheet. A high-risk fund could mean that the fund is invested in volatile industries like technology.

Source: Al Ahli Asia Pacific Index Fund, 30 June 2021

Historical Returns

Even though it is not possible to guarantee a definite return with funds, the historical returns of a fund can give investors an idea of the potential returns.

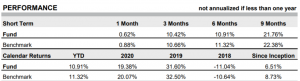

If a fund has been on the market for some time, the historical returns may be shown across a certain period (e.g. 1 month, 3 months, 6 months, 1 year, 5 years, or 10 years). This is to show the cumulative returns an investor may receive if they invest in this fund for the shown period of time. For instance, if you invest $1000, and the 1 month return of a fund is 0.62%, your investment is now worth $1006.20.

Source: Al Ahli Europe Index Fund, 30 June 2021

Most fund houses will present a graphical depiction of the calendar year performance of the fund. From there, an investor can use these figures to gauge the potential returns.

Fees

Before you look into a fund, pay attention to the fees you’re required to pay, including the service fees paid to the fund managers. If you’re going to be paying high fees, then it defeats the purpose of obtaining profitable returns.

Among the fees to look out for are:

- Subscription fee – A fee for when you buy into the fund

- Redemption fee – A fee for when you want to redeem your money

- Management fee – A fee for the fund managers, usually charged annually.

Fund Manager’s Details

Other pieces of information you can find in an investment factsheet include the fund manager’s details.

You can bank on the fund manager’s expertise for the success of a fund. Details of the fund managers are crucial as these groups of people are the ones that will be steering the ship of a fund.

A fund factsheet may show the fund’s track record, qualification, and years of experience a team of fund managers has. For additional insights, look into different funds that are managed by a fund manager to view the performance record.

You are investing your money, and you want them to be in good hands. So, having a dedicated team of fund managers will aid in achieving your investment goals.

Why should you read a fund factsheet?

A fund factsheet tells you the key information of a fund. As a responsible investor, you should know where your money is being invested, the type of risk you would be facing, and the potential returns you could be gaining.

By reading a fund factsheet, you can tell if you’re aligned and moving forward with your investment goals. With that being said, all the information provided in a fund factsheet does not guarantee a positive outcome. Meaning, the historical returns on a fund fact sheet or the holdings on a fund fact sheet will not guarantee a profitable return on your investment.

All investment is subject to market risk, hence manage your expectations when you’re investing. So, if you’ve been planning to invest in a fund, get your hands on a fund factsheet to help you make an informed decision.

Share what you've learned

You may also enjoy

Different Styles of Investing

What to Do With Your Annual Bonus