Swiping has never been

more rewarding

Register for a BIBD debit or credit card and receive an exclusive gift today!

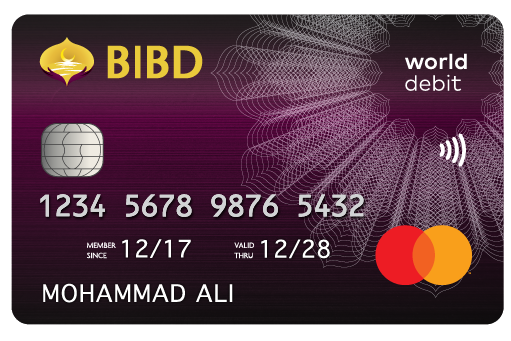

The Debit Cards

BIBD Debit Mastercard

BIBD World Debit Mastercard

Hassle-Free Transactions

Contactless Payment

Say goodbye to the hassle of carrying cash and counting change. Easily make payments at various merchants with just a swipe or a tap.

Secure

Enjoy the convenience of electronic payments while having the peace of mind that your financial information is safeguarded, empowering you to transact with confidence.

Eligibility

- Brunei Citizens, Permanent Residents and Foreigners.

- Individuals aged 18 years & above and have a Savings account with BIBD

- Brunei Citizens, Permanent Residents and Foreigners

- Individuals aged 18 years & above having a Savings acccount with BIBD and holding PERDANA membership

Fees

No annual fees!

Please refer to the bank’s Schedule of Tariff for related fees.

No annual fees!

Please read the Product Disclosure Sheet before you decide to apply for debit card.

Further Information

The Shariah Concept for Debit Cards is

Al- Wakalah Bil Ujrah (Agency with fee)

The Bank will act as an agent (“Wakil”) by providing Direct Debit Point of Sales (POS) service and cash Automated Teller Machine (ATM) withdrawals service to Cardholders for a prescribed fee.

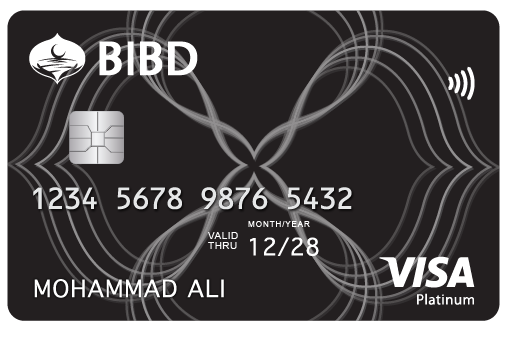

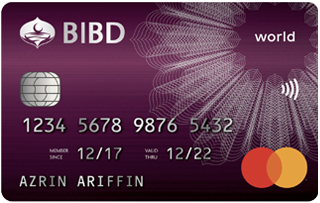

The Credit Cards

BIBD Classic Mastercard BIBD Gold Mastercard BIBD Visa Gold BIBD Visa Platinum BIBD World Mastercard

Benefits

Benefits

Convert purchases into an affordable 0% monthly instalment scheme with BIBD Easy Payment Plan*

*Please refer to Terms & Conditions

VISA Benefits

VISA Convert purchases into an affordable 0% monthly instalment scheme with BIBD Easy Payment Plan*.

*Please refer to Terms & Conditions

Emergency Cash Advance of up to US$3,000

Convert purchases into an affordable 0% monthly instalment scheme with BIBD Easy Payment Plan*

*Please refer to Terms & Conditions

Convenient & Secure

Lounge Access

Enjoy the perfect blend of convenience and security as you make quick and effortless payments at various merchants and online, knowing that our security features ensure your transactions are always protected.

Convenient & Secure

VISA Enjoy the perfect blend of convenience and security as you make quick and effortless payments at various merchants and online, knowing that our security features ensure your transactions are always protected.

Reward

| B$1 spent | = | 2 Hadiah Points |

| B$1 spent | = | 2 Hadiah Points |

| B$1 spent | = | 2 Hadiah Points |

| B$1 spent | = | 3 Hadiah Points |

| B$1 spent | = | 4 Hadiah Points |

Eligibility

- Brunei Citizens, Permanent Residents and Foreigners.

- Primary Cardholders – Individuals aged 21 years & above

- Supplementary Cardholders – Individuals aged 18 years & above

VISA

- Brunei Citizens, Permanent Residents and Foreigners.

- Primary Cardholders – Individuals aged 21 years & above

- Supplementary Cardholders – Individuals aged 18 years & above

- Brunei Citizens, Permanent Residents and Foreigners.

- Primary Cardholders – Individuals aged 21 years & above

- Supplementary Cardholders – Individuals aged 18 years & above

Fees

Principal Cardholder – B$35

Supplementary Cardholder – B$15

Please refer to the bank’s Schedule of Tariff for related fees.

Fees waived*

Principal Cardholder – B$120

Supplementary Cardholder – B$60

Principal Cardholder – B$120*

Supplementary Cardholder – B$60

*Waived when a minimum of B$12,000 spent within 12 months period.

Principal Cardholder – B$250*

Supplementary Cardholder – B$125

*Waived when a minimum of B$18,000 spent within 12 months period.

Takaful Coverage

Not Available

Automatically covered with Takaful Coverage for Travel Personal Accident

Automatically covered with Takaful Coverage for Travel Personal Accident Protection up to B$25,000.

Automatically covered with Takaful Coverage for:

- Travel Personal Accident Protection up to B$50,000

- Card Purchases Protection up to B$5,000

- Travel Personal Accident (up to BND 50,000)

- Card Purchases Protection (up to BND 5,000)

- Schedule Flight Event (Musafir)

The Shariah Concept for Credit Cards are

Al-Wakalah Bil Ujrah (Agency with fee)

BIBD is acting on behalf of the Cardholder to administer the Cardholder’s payment to the Merchant and managing the Card Account with the imposition of a prescribed fee.

Al-Kafalah bil Mal (Financial Guarantee)

Financial Guarantee – BIBD guarantees the Merchant for the Cardholder’s payment for the goods or services provided by the Merchant.

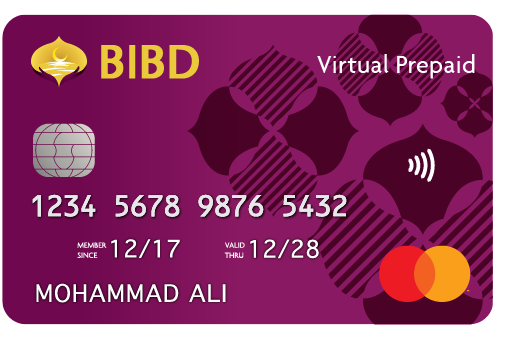

Reality in the virtual world

This virtual card opens the door to seamless and secure money transfers and payments.

Convenient & Secure

Enjoy the flexibility of making online payments without the need for a physical card, while our security features ensure that your transactions are protected.

Streamline your shopping experience, withdraw at BIBD ATM’s without a debit card and many more.

The Virtual Prepaid Card

Pay with your NEXGEN Wallet

You can now perform transfers easily to any of your phone contacts with a BIBD Virtual Prepaid card. No more typing down those long account numbers!

Other things you can do with Virtual Prepaid:![]() Cardless Withdrawal

Cardless Withdrawal![]() QuickPay

QuickPay

Eligibility

- Brunei Citizens, Permanent Residents and Foreigners

- Individuals aged 18 years & above and have a Savings Account with BIBD.

Fees

No annual fees!

Please refer to the bank’s Schedule of Tariff for related fees.

Benefits

Emergency Cash Advance of up to US$3,000

Convert purchases into an affordable 0% monthly instalment scheme with BIBD Easy Payment Plan*

*Please refer to Terms & Conditions

Debit Card

Do away with the hassle of paying with cash as payment with the Card were made directly from BIBD account.

Airport Lounge Access

Access to 1,000 lounges in over 400 airports worldwide

Access

Accepted worldwide at over 43 million merchants and 2.3 million ATMs including online transactions.

Reward

B$1 spent | = | 4 Hadiah Points |

None

Perdana Exclusive Cards

BIBD World Debit Mastercard BIBD World Mastercard

Eligibility

- Brunei Citizens, Permanent Residents and Foreigners.

- Primary Cardholders – Individuals aged 21 years & above

- Supplementary Cardholders – Individuals aged 18 years & above

Fees

- Principal Cardholder – Waived

- Supplementary Cardholder – Waived up to 2 supplementary cardholders.

Fees waived

Insurance

Automatically covered with Takaful Coverage for:

- Travel Personal Accident (up to B$50,000)

- Schedule Flight Event Protection (up to B$5,000)

- Card Purchases Protection (up to B$ 5,000)

None

Product Disclosure Sheet

Please read the Product Disclosure Sheet before you decide to apply for debit card.

*Waived up to 2 supplementary world credit card only. Subsequent cards will be charged at BND 180 per card.

The Shariah Concept for Virtual Card is

Al-Wakalah Bil Ujrah (Agency with fee)

The Bank will act as an agent (“Wakil”) by providing Direct Debit Point of Sales (POS) service and cash Automated Teller Machine (ATM) withdrawals service to Cardholders for a prescribed fee.

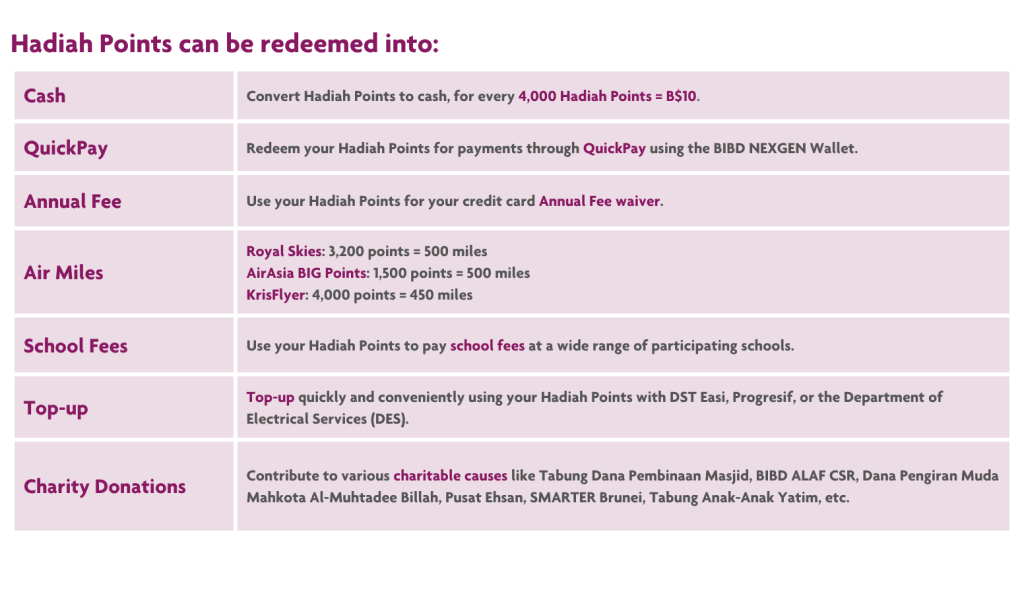

BIBD Hadiah Points

A Reward Point feature awarded to you whenever you use your BIBD Credit Card

Hadiah Points can be redeemed for cash, air miles, fee waiver, donation to charities, bill payment, purchase of prepaid credits and QuickPay payments.

How can I earn Hadiah Points?

Hadiah Points can be earned by simply paying with your BIBD Credit Cards. The more you spend, the higher the points you’ll be awarded.

How to check on my available Hadiah Points?

Log in to BIBD NEXGEN Online or BIBD NEXGEN Wallet: Click Account Services and then Hadiah Points.

Please take note of the expiry date of your Hadiah Points. Ensure that you redeem them before the expiry date to enjoy the benefits of your Hadiah Points. You may also check it from your latest Credit Card Statement.

What can I redeem with my Hadiah Points?

Convert your Hadiah Points to Cash!

- Call our BIBD Contact Centre at 2238181,

- Chat with our Contact Centre Agent via BIBD NEXGEN Wallet Mobile Chat, or

- Visit any BIBD Branch near you for cash redemption over the counter.

Note: Please take note that you must have a minimum of 4000 Hadiah Points to convert it into cash.

Can’t Decide On Which Card Is For You?

Our comparison chart provides an overview of all offerings available across on all our cards